michigan sales tax exemption rolling stock

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Direct Pay - Authorized to pay use tax on qualified transactions directly to the State of Michigan under.

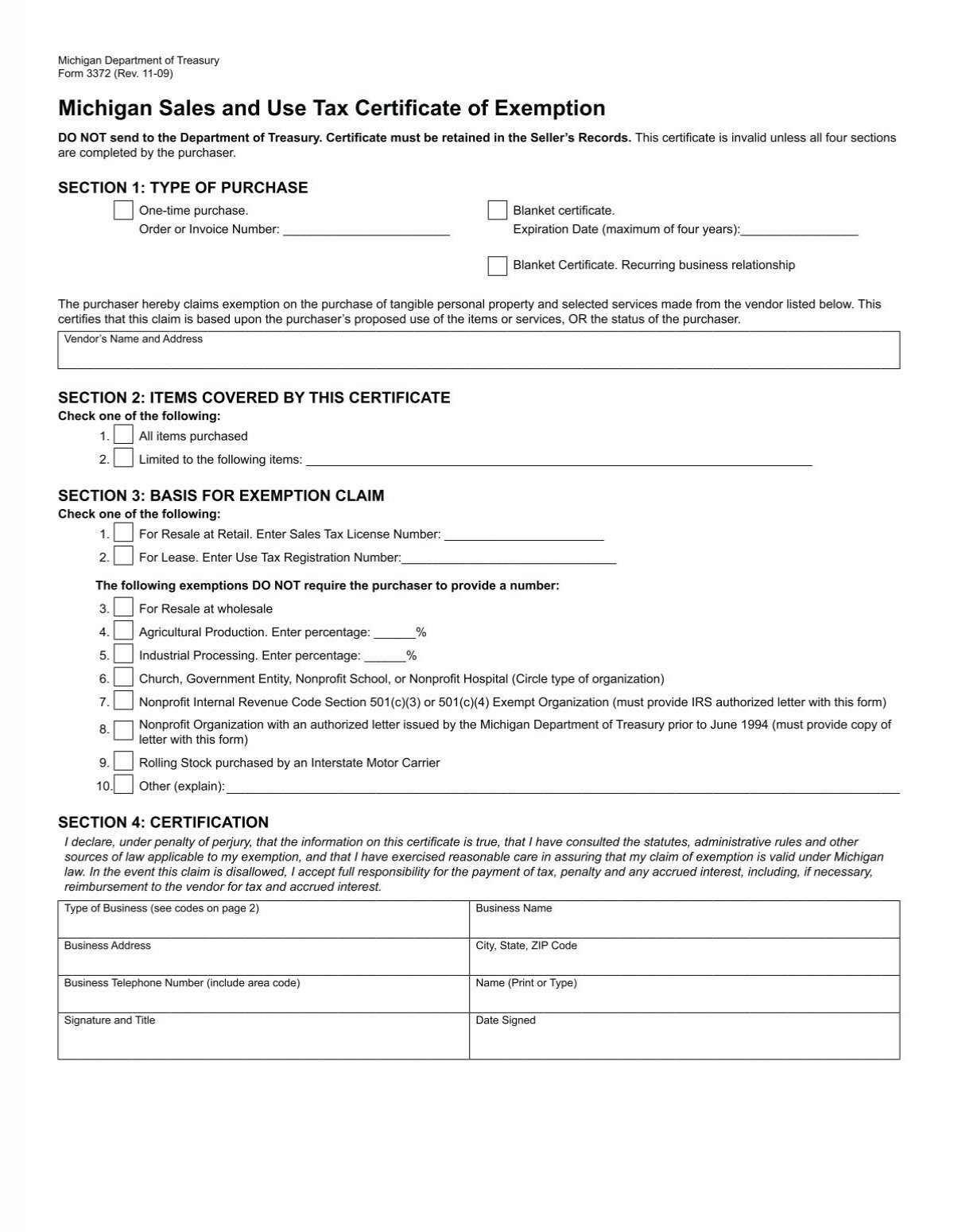

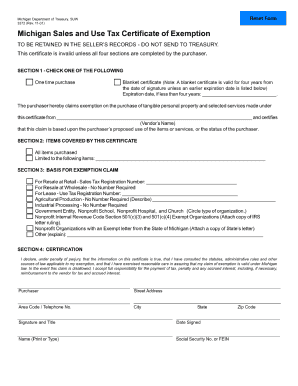

Michigan Sales And Use Tax Certificate Of Exemption

Qualified Data Center 12.

. Terms Used In Michigan Laws 20554r. Senate Bill 544 S-1 would amend the General Sales Tax Act to exempt from the tax sales of rolling stock purchased by an interstate motor carrier and used in interstate commerce. A Michigan sales tax increase from 3 to 4 percent was approved by voters in 1960 effective in 1961.

Michigan use tax was enacted four years later effective October 29 1937. To expand a sales tax. Section 20554r - Qualified truck trailer or rolling stock.

Michigan Laws Bills and Votes using concise plain and objective descriptions. Michigan Sales and Use Tax Certicate of Exemption INSTRUCTIONS. Definitions 1 All of the following are exempt from the tax under this act.

DO NOT send to the Department of Treasury. Sales Tax Exemptions in Michigan. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

The Michigan General Sales Tax Act took effect June 28 1933. Expand rolling stock sales tax exemption. A The product of the out-of-state usage.

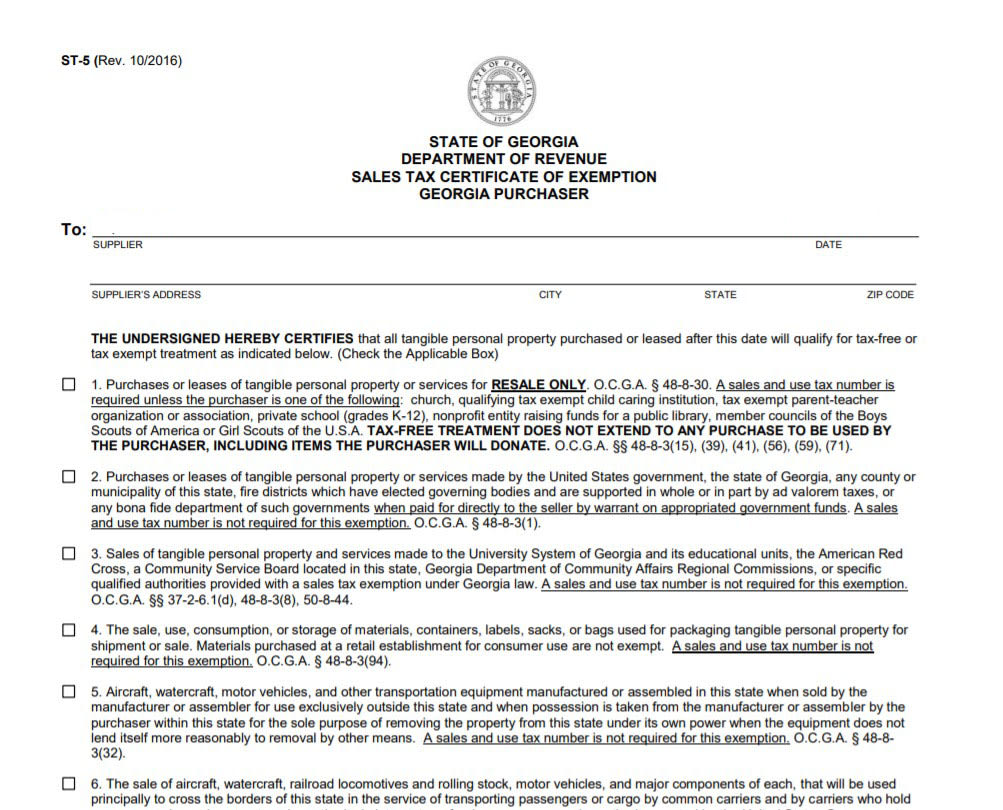

Qualied Data Center 12. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Sales for resale government purchases and isolated sales were exemptions originally included in the Act.

Rolling Stock purchased by an Interstate Motor Carrier. Her first bill would once again. Rolling Stock purchased by an Interstate Motor Carrier.

Several examples of exemptions to the states. 5567 amended the General Sales Tax Act to provide a partial sales tax exemption for sales of qualified trucks and trailers for taxes levied after December 31 1996 and before May 1 1999. It is the Purchasers.

Interstate fleet motor carriers who qualify for exemption may claim exemption from sales or use tax by providing the seller or lessor with the prescribed Michigan Sales and Use Tax Certificate. Includes an activity engaged in by a person or caused to be engaged in by that person with the object of gain benefit or advantage either. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions.

This page discusses various sales tax exemptions in Michigan. Shanelle Jackson D-Detroit has taken the lead in pursuing legislation that would call on Michigan truckers to pay even more taxes to the state. How to use sales tax exemption certificates in Michigan.

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

News Fort Wayne Railroad Historical Society

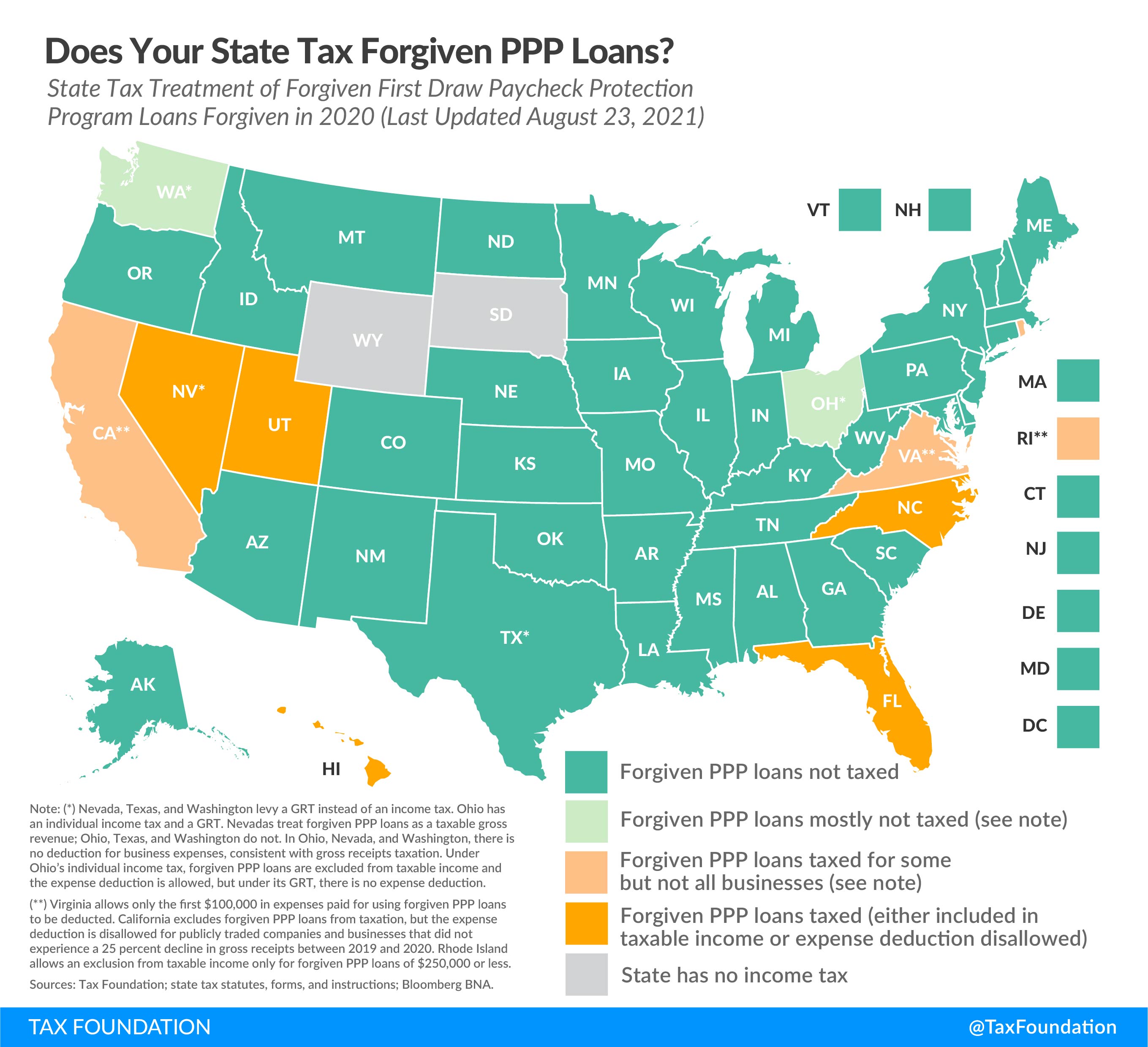

2021 State Business Tax Climate Index Tax Foundation

Mi Sales Tax Exemption Form Animart

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Customer Forms Lasting Impressions

Form 1028 Fillable Annual Property Report State Assessed Railroads

Exemptions From The Michigan Sales Tax

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Pact Act Document Requirements

Understanding Use Tax Exemption On The Transfer Of Vehicles Between Relatives And Others Shindelrock

State And Local Tax Advisor September 2021 Our Insights Plante Moran

Form 1028 Fillable Annual Property Report State Assessed Railroads

Michigan Sales Tax Exemptions Agile Consulting Group

Irs Form 3372 Fill Online Printable Fillable Blank Pdffiller