utah solar energy tax credit

As a credit you take the amount directly off your tax payment. The solar tax credit will be 30 from 2022 to 2032 and will drop to 26 in 2033 and 22 in 2034.

Congress Passes 30 Energy Tax Credit Harness The Power Of The Sun With Hedgehog Electric Solar St George News

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 30 6000.

. That will decrease to 26 for systems installed in 2033 and to 22 for systems installed. The credit drops to a maximum of 800 in 2022 and 400 in. Utah offers state solar tax credits -- 25 of the purchase and installation costs of a solar system -- up to a maximum of 2000.

You can claim 25 percent. Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes. Those who install a PV system between 2022 and 2032 will receive a 30 tax credit.

Plus solar owners can cash in on Utahs net. Additionally the state of Utah offers its own solar panel tax credit that allows you to claim up to 25 of your costs up to 1600. Market-based tax incentives drive new investment that diversifies enhances and expands our energy and minerals portfolio providing beneficial outcomes for Utahs economy.

Attach TC-40A to your Utah return. Alternative Energy Manufacturing Tax Credit. Write the code and amount of each refundable credit in Part 5.

And SALT LAKE CITY UT - The Solar Energy Industries Association SEIA and the Utah Solar Energy Association USEA jointly thanked Utah Gov. Skip to main content facebook. Total the amounts and carry the total to TC-40 line 38.

Commercial Utah offers a suite of tax credits for. The federal tax credit falls to 26 at the end of 2032. Find other Utah solar and renewable energy rebates and incentives on Clean Energy Authority.

The Alternative Energy Manufacturing Tax Credit is a nonrefundable tax credit for up to 100 of new state tax revenues including state corporate sales and withholding taxes over the life of. Residential tax credits span rooftop solar as well as installations utilizing solar thermal wind geothermal hydro and biomass technologies. The credit is set to expire in 2035 so it might be smart to invest in solar panels.

The Utah Office of Energy Development administers the tax credit and has responsibility for revising the tax credit rules and certifying systems as eligible for the credit. Codes for Refundable Credits TC-40A. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs.

Utah once offered homeowners a tax credit to cover 25 of the cost of installing rooftop solar panels up to 2000.

2020 Solar Rebates And Incentives Statistics

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Experts From Top Renewable Energy Companies Weigh In Utah Business

Solar Panels Contractors In Utah Letsgosolar Com

15 Things You Should Know About Utah Solar Incentives

Understanding The Utah Solar Tax Credit Ion Solar

![]()

Rooftop Solar Utah Clean Energy

Inflation Reduction Act Gives Solar Power Its Latest Push Forward Economics Goskagit Com

Utah Red Hills Renewable Park Solar Power Facility Parowan Utah

Solar Energy Company In Intermountain Wind Solar

Advocates Worry Rocky Mountain Power Rate Change Could Kill The Solar Industry Here In Utah Parkrecord Com

Understanding The Utah Solar Tax Credit Ion Solar

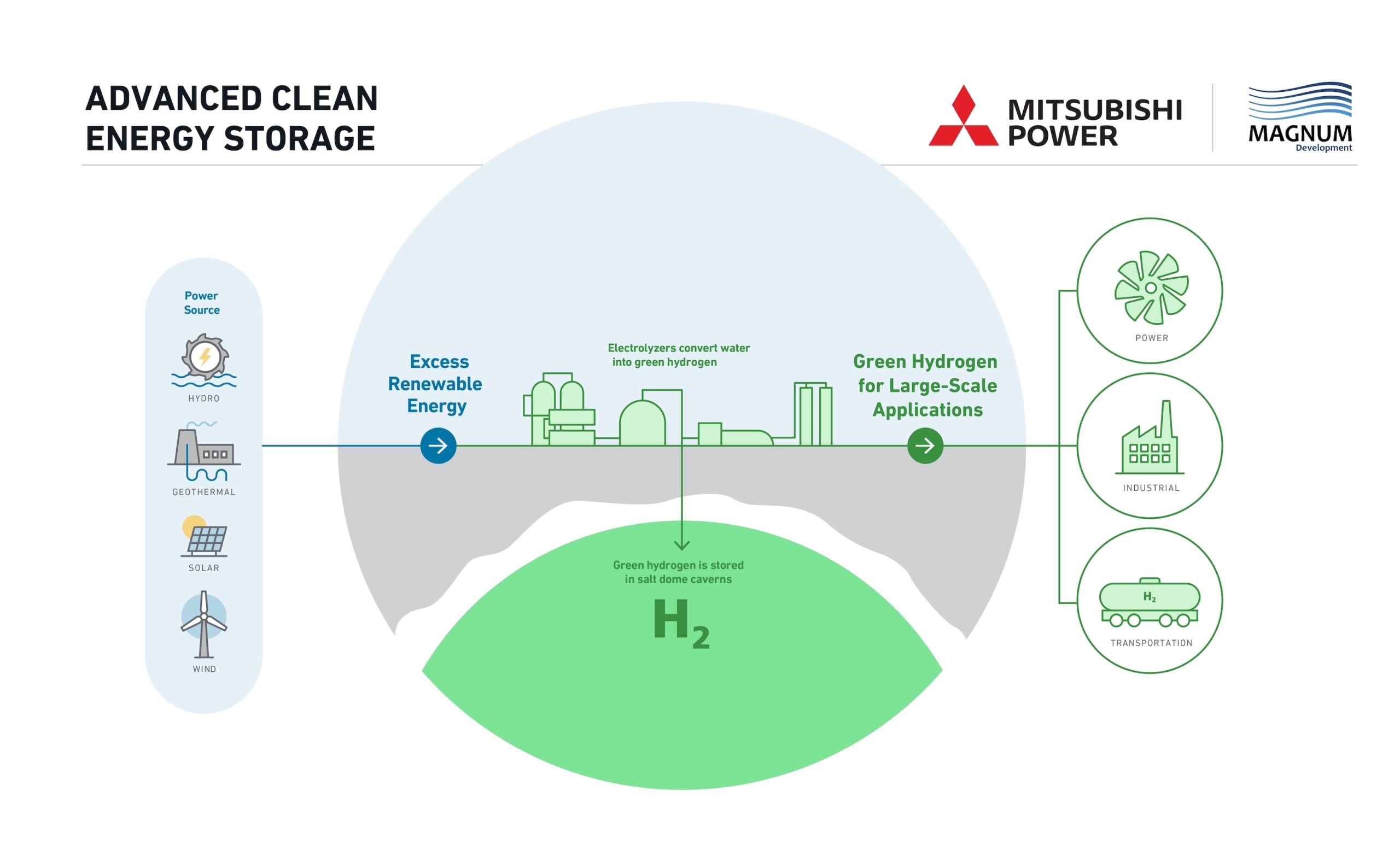

Department Of Energy Confirms Us 504 Million Loan To 300gwh Utah Hydrogen Energy Storage Hub Energy Storage News

Renewable Energy Systems Tax Credit Office Of Energy Development

The Best Solar Companies In Utah Top Solar Installers In Ut 2021

Utah Solar Incentives 2022 Cost And Savings Saveonenergy

Revision Energy S Guide To The Federal Solar Tax Credit

Peak Sun Hours For Solar Panels In Utah Turbinegenerator Org